10 secret tips to save money that only few people know

You may know ‘n’ number of ways to earn

money but for saving? Every richest person on the earth knows how to manage

their money and how to spend it wisely. Saving is one of the key factor that

makes the difference between common man and rich man. By reading this article,

we’re are 100% sure that you’re going to save minimum 1000Rs from next month.

10Open Savings A/c in Bank offering highest interest rate

Now banks are offering highest rate of interest for

the money you’re saving on your Savings Account.

HDFC offers 4% per annum and Kotak bank offers 5% per

annum.

How the savings account interest is rates are calculated?

As per the new RBI mandate, interest on savings

account is calculated on a daily basis based on your closing amount. The

interest accumulated will be credited to your account on half yearly basis or

quarterly basis depending on the savings account type and the bank’s rule.

However, recently, the Reserve Bank of India has advised the banks to credit

the interest on Savings Bank account on quarterly basis as it will be more

beneficial to the customers.

Generally, the formula described below is used to

calculate the monthly interest for a general savings account.

Monthly Interest = Daily Balance * (Number of days) *

Interest / (Days in the year)

Assuming the daily balance is Rs. 3 lakhs and the

interest on savings account is 4 per cent per annum, the calculation will work

out as follows.

Monthly Interest = 3 lakhs * 30 * (4/100) / 365 = Rs.

986

9Saving From Income Tax

That is the favourite way of saving money for everyone.

Everyone wants to earn more income but no one wants to pay income taxes.

Government keeps on introducing various ways of saving

income tax but it becomes difficult to understand all the plans.

There are some investment options like PPF, NSC, and

LIC premium paid and 5 years FD with banks & post offices are exempted from

income tax up to limit of Rs 1,50,000 under sec 80C. You can also save tax on

expenses like medical bill, daily travel expenses and mobile bills.

- U/s 80C – Over all exemption is Rs 100,000/year(Investment in ELSS, PPF, NSC, LIC, Home Loan Principal etc)

- U/s 80D – Over all exemption is Rs 15,000 (Rs 20,000 for Senior Citizen) (Health insurance for self, family, dependent parents)

- U/s 80E – 100% interest on education Loan is exempted

from Income Tax

(Education loan taken for higher studies of self,

spouse, children)

8Buy a Health Insurance Policy

A question may arise in your mind. How it is possible

to save money by buying a health insurance when you have to pay premium every

year?

My dear friend, it’s better to spend 10,000 per year

on premium of a health insurance rather than paying a big money on treatment of

unexpected hospitalization.

Money spent on premium of health insurance is the only

money that I wish to get wasted. I don’t want any ROI by going to hospital.

Diseases and accidents comes without an invitation.

You may save couple of lakh rupees on hospital expenses in case of emergency.

Read – Top

Health Insurance Companies in India 2017

7Use credit card

Recently, every banks started to

limits the ATM transaction per month. If you’re not tracking the ATM

transaction then you’ll end up in paying charges. So try to avoid liquid cash

as maximum as possible and start transacting with credit card.

Benefits of using credit card.

·

Easy access to credit

·

Building a line of credit

·

EMI facility

·

Incentives and offers

·

Flexible credit

·

Record of expenses

·

Purchase protection

6Say No To Restaurant, Cook at Home

Since India became IT hub of the

world where you can get anything done by spending small money, people started

to follow the IT culture to dine out and Saturday parties. Sometimes is okay

but not all the time. As the Indian announced GST on 1st April 2017,

all the restaurants increased their prices and also the taxes.

“Not only you eating, GST tooâ€

5Pay the Bills on Time

Think a moment, how many times you

missed to pay your bill on time and you incurred late payment charges in a

year? Try to pay your post-paid, credit card bills, electricity bills on time

using Autopay banking facilities. Every bank including HDFC, CITI, ICICI

offering autopay option and some banks even giving 1% cashback for registering

that service.

Also always maintain minimum balance

in your bank account, If you’re not using that account go ahead and close it

otherwise you’ll incur charges. Do you know SBI expects to realise over Rs 2,000

crore from account holders as penalty for failing to maintain minimum balance

in their savings accounts

4Make use of Referral bonus

Nowadays, every business offers a bonus

for customers who introduce their business to other customers. Even in IT

industry, when you refer your friend and if he/she got selected you’ll get some

handsome amount to your packet. Whenever you have opportunity to refer, refer

your friends and family.

For example, if

you’re a UBER user and you refer a friend then you’ll get a free ride when your

friend makes a trip with UBER.

If you’re a

Citibank customer and you have friend looking for credit card, refer him to

Citi and Citi offers you 2000Rs cash in return.

3Shopping Online

Shopping online is really a good

option nowadays as it always save some bucks. When you decide to buy an item

through e-commerce sites or booking a ticket, you should always do a market

research before buying an item.

Here are some tips to save money

while shopping:

• Compare the prices before buying any product online. You can use tools like Makkhi Choose that automatically show the price of the same product on all websites at the same time. This websites compares prices of a product in all the e-commerce giants like Amazon, Flipkart, snap deal and gives you the cheapest price.

• Check for additional cashback – There are some cashback websites that offers additional benefits when you shop through their links. For example cashkaro and gopaisa.

• Use payment wallets like Paytm, Mobikwik, Freecharge, PayU to get additional discounts on shopping. PayUMoney gives 1% cashback on online transaction.

• Interest Free EMI on your credit card. Avail the offer to enjoy interest free debt when some companies offer zero interest EMI in peak shopping season.

• Use Free Shipping – While comparing the price also compare the shipping charges. Sometimes lesser price website charges higher shipping charges. Never waste money for delivering your product.

Amazon provides free shipping on orders above Rs 499 but Paytm charges shipping on each product separately. If you order 5 products from paytm then you have to pay 5 times the shipping. Better to shop from Amazon for multiple products.

2Never buy an item which is not necessary at that point of time

When you go for shopping, always go

with a list of items to buy and fixed budget. There are many marketing strategy

evolving over the years to make buyers to buy many products when they are in

for the shopping. Never buy an item that is not on your list.

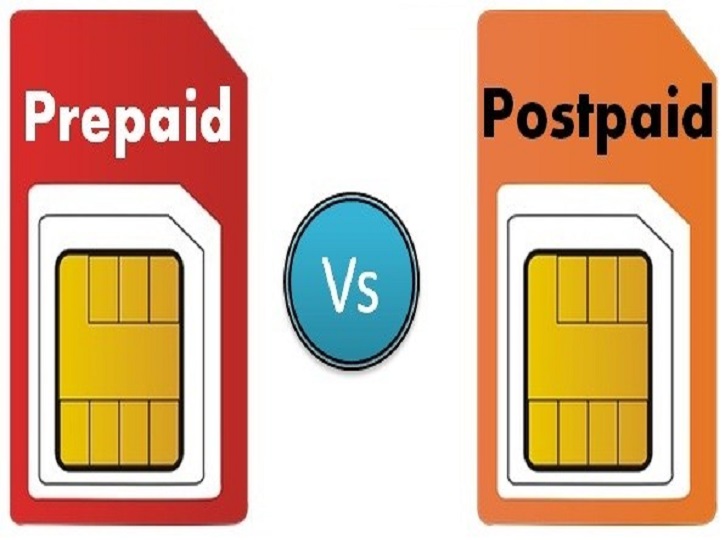

1Switch post-paid plans to prepaid plans

If

you think that post-paid is better than prepaid, then it’s a bad idea. Why?

• Prepaid offers full-talk time plans without any taxes charged whereas in post-paid you’ll end up paying 15% tax of your total bill.

• If you are an incredible internet surfer and you accidently clicked some ads running on the website that will subscribe some plans and will make you to pay from 50-500Rs out of your packet.

• You don’t have control over youy potpaid bill amount. Even though you track your data usage, there is a chance of usage beyond the plan limit that will make you to pay huge money.

• If you have to change the telecom provider which offers best service and cheap price, then it’s easy to change your telecom provider through MNP (Mobile number portability). But, it’s very difficult to change, if you’re a post-paid user.

To get the latest top10 list, follow Mowval on Facebook, Twitter and Google Plus.